Fraud Detection Using Machine Learning and Blockchain

Main Article Content

Abstract

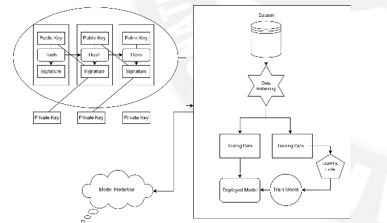

In the 21st century financial fraud is on the rise in many institutions. Newly released Federal Trade Commission data shows that consumers reported losing nearly $8.8 billion to fraud in 2022, an increase of more than 30 percent over the previous year. The main goal for us is to develop an efficient fraud detection system and utilize blockchain to create a decentralized banking application. Our team has collaborated on various cutting-edge technologies, such as machine learning and blockchain, to create a sophisticated fraud detection system. We have implemented three machine learning algorithms, namely Logistic Regression, Decision Tree, and Random Forest, which have been used to improve the accuracy of the model for detecting fraudulent activities. As for fraud aversion, we have used the Blockchain technology which provides a tamper-proof system that can securely record and track financial transactions, ensuring transparency and security. This feature makes it an ideal solution for fraud prevention, as it guarantees that all transactions are legitimate and free from any manipulations. By combining the power of machine learning and blockchain technology, our team is confident in providing an innovative solution that will benefit all stakeholders involved

Article Details

References

V. Silaparasetty, “Machine Learning and blockchain for fraud detection: Employing artificial intelligence in the banking sector,” GCU INTERNATIONAL KNOWLEDGE TRANSFER CONCLAVE - (ISBN 978-93-86516- 46-6), 2018.

C.Mallesha& S.Haripriya,A STUDY ON BLOCKCHAIN TECHNOLOGY IN BANKING SECTOR, International Journal of Advanced Research in Commerce, Management & Social Science,, Volume 02, No. 03, July - September, 2019, pp 123-132.

Mr. Dharmesh Dhabliya, Mr. Rahul Sharma. (2012). Efficient Cluster Formation Protocol in WSN. International Journal of New Practices in Management and Engineering, 1(03), 08 - 17. Retrieved from http://ijnpme.org/index.php/IJNPME/article/view/7

M. Ostapowicz and K. Z' bikowski, “Detecting fraudulent accounts on blockchain: A supervised approach,” in Web Information Systems Engineering – WISE 2019, Cham: Springer International Publishing, 2019, pp. 18–31.

Dr.Ahmed Muayad Younus, Mohanad Abumandil, “Role of Smart Contract Technology Blockchain Services in Finance and Banking Systems: Concept and Core Values” in Advanced Engineering Informatics - January 2022, 1013465.

Dr. Dhananjay Kalbande, Pulin Prabhu, Anisha Gharat, Tania Rajabally, A Fraud detection system using Machine Learning, Department of Computer Engineering Sardar Patel Institute of Technology.

Deshpande, V. (2021). Layered Intrusion Detection System Model for The Attack Detection with The Multi-Class Ensemble Classifier . Machine Learning Applications in Engineering Education and Management, 1(2), 01–06. Retrieved from http://yashikajournals.com/index.php/mlaeem/article/view/10

Thulya Palihapitiya, Blockchain Revolution in Banking Industry-October 2020.

Pemith Waidyaratne,"A Review on Blockchain Technology and the Impact on Finance Sector by Blockchain Technology", General Sir John Kotelawala Defence University: July 2022.

T. H. Pranto, K. T. A. M. Hasib, T. Rahman, A. B. Haque, A. K. M. N. Islam, and R. M. Rahman, “Blockchain and machine learning for fraud detection: A privacy-preserving and adaptive incentive-based approach,” IEEE Access, vol. 10, pp. 87115–87134, 2022.

S P Maniraj, Aditya Saini, Shadab Ahmed, Swarna Deep Sarkar, “Credit Card Fraud Detection using Machine L e a r n i n g a n d D a t a S c i e n c e ”- IJERT-September 2019.

Pradheepan Raghavan, Neamat El Gayar, Fraud Detection using Machine Learning and Deep Learning, December 2019.

Cai, Y., & Zhu, D. (2016). Fraud detections for online businesses: a perspective from blockchain technology. Financial Innovation, 2(1), 1-10.

Rui Roriza, José LuisPereira, “Avoiding Insurance Fraud: A Blockchain-based Solution for the Vehicle Sector” ScienceDirect-Procedia Computer Science 164 (2019) 211–218.

Paul Sarda, Mohammad Jabed Morshed Chowdhury, Alan Colman, Muhammad Ashad Kabir, Jun Han, “Blockchain for Fraud Prevention: A Work-History Fraud Prevention System”-IEEE-2018.

Joshi, P., Kumar, S., Kumar, D., & Singh, A. K. (2019, September). A blockchain based framework for fraud detection. In 2019 Conference on Next Generation Computing Applications (NextComp) (pp. 1-5). IEEE.

Dhiran, A., Kumar, D., & Arora, A. (2020, July). Video Fraud Detection using Blockchain. In 2020 Second International Conference on Inventive Research in Computing Applications (ICIRCA) (pp. 102-107). IEEE.

Pathak, D. G. ., Angurala, D. M. ., & Bala, D. M. . (2020). Nervous System Based Gliomas Detection Based on Deep Learning Architecture in Segmentation. Research Journal of Computer Systems and Engineering, 1(2), 01:06. Retrieved from https://technicaljournals.org/RJCSE/index.php/journal/article/view/3

Nerurkar P, Bhirud S, Patel D, Ludinard R, Busnel Y, Kumari S. Supervised learning model for identifying illegal activities in Bitcoin. Appl Intell. 2020;209(1):120.

Ostapowicz, M., & Z' bikowski, K. (2020, January). Detecting fraudulent accounts on blockchain: a supervised approach. In International Conference on Web Information Systems Engineering (pp. 18-31). Springer, Cham.

Raikwar, M., Mazumdar, S., Ruj, S., Gupta, S. S., Chattopadhyay, A., & Lam, K. Y. (2018, February). A blockchain framework for insurance processes. In 2018 9th IFIP International Conference on New Technologies, Mobility and Security (NTMS) (pp. 1-4). IEEE.

B. K., P., Naikodi, C. ., & Suresh L. (2023). Hybrid Meta-Heuristic Technique Load Balancing for Cloud-Based Virtual Machines. International Journal of Intelligent Systems and Applications in Engineering, 11(1), 132–139. Retrieved from https://ijisae.org/index.php/IJISAE/article/view/2451.

Rodriguez, L., Rodríguez, D., Martinez, J., Perez, A., & Ólafur, J. Leveraging Machine Learning for Adaptive Learning Systems in Engineering Education. Kuwait Journal of Machine Learning, 1(1). Retrieved from http://kuwaitjournals.com/index.php/kjml/article/view/103

Vaishali Mohite, Lata Ragha, “Cooperative Security Agents”, World Congress on Information and Communication Technologies (WICT-2012), 30th Oct - 2nd Nov 2012, Trivandrum, India, Publication- IEEE Xplore and indexed by EI Compendex and ISTP, 978-1-4673-4805-8/12/$31.00© 2012 IEEE.

Vaishali Gaikwad (Mohite), Lata Ragha, “Security Agents for Detecting and Avoiding Cooperative Blackhole Attacks in MANET”, Applied & Theoretical Computing & Communication Technology, from October 29-31, 2015, SCI, IEEE Part Number: CFP15D66-USB IEEE ISBN: 978-14673-9222-8-$31.00© 2015 IEEE held in BIT, Karnataka, India.

Isabella Rossi, Reinforcement Learning for Resource Allocation in Cloud Computing , Machine Learning Applications Conference Proceedings, Vol 1 2021.

CipherTrace.[Online].Available:https://ciphertrace. com/. [Accessed: May. 13, 2023].

Chainalysis.[Online].Available:https://chainalysis.com/. [Accessed: May. 13, 2023].

Elliptic.[Online].Available:https://www.elliptic.co/. [Accessed: May. 13, 2023].

AnChain.AI.[Online].Available:https://www.anchain.ai/. [Accessed: May. 13, 2023].

Scorechain.[Online].Available:https://www.scorechain.com/. [Accessed: May. 13, 2023].

Nuggets.[Online].Available:https://nuggets.life/. [Accessed: May. 13, 2023].

MetaCert.[Online].Available:https://metacert.com/. [Accessed: May. 13, 2023].

BigPanda.[Online].Available:https://www.bigpanda.io/. [Accessed: May. 13, 2023].

UnboundTech.[Online].Available:https://www.unboundtech.com/. [Accessed: May. 13, 2023].

Forte.[Online].Available:https://www.forte.io.[Accessed: May. 13, 2023]..